Get to Know Us: UT Federal Credit Union

Growing with UTFCU: How Seeds of Change Built a Thriving Business

From a single truck loan to a thriving landscaping business, Ian Dovan's journey with UTFCU is a story of growth, resilience, and community impact. Discover how Seeds of Change has flourished with the right financial partner by its side.

Financial Strategies for Caregivers: Managing Expenses and Securing Stability

Balancing caregiving responsibilities and financial stability can be challenging. Discover smart financial strategies to manage expenses, plan for the future, and access valuable resources to support your journey.

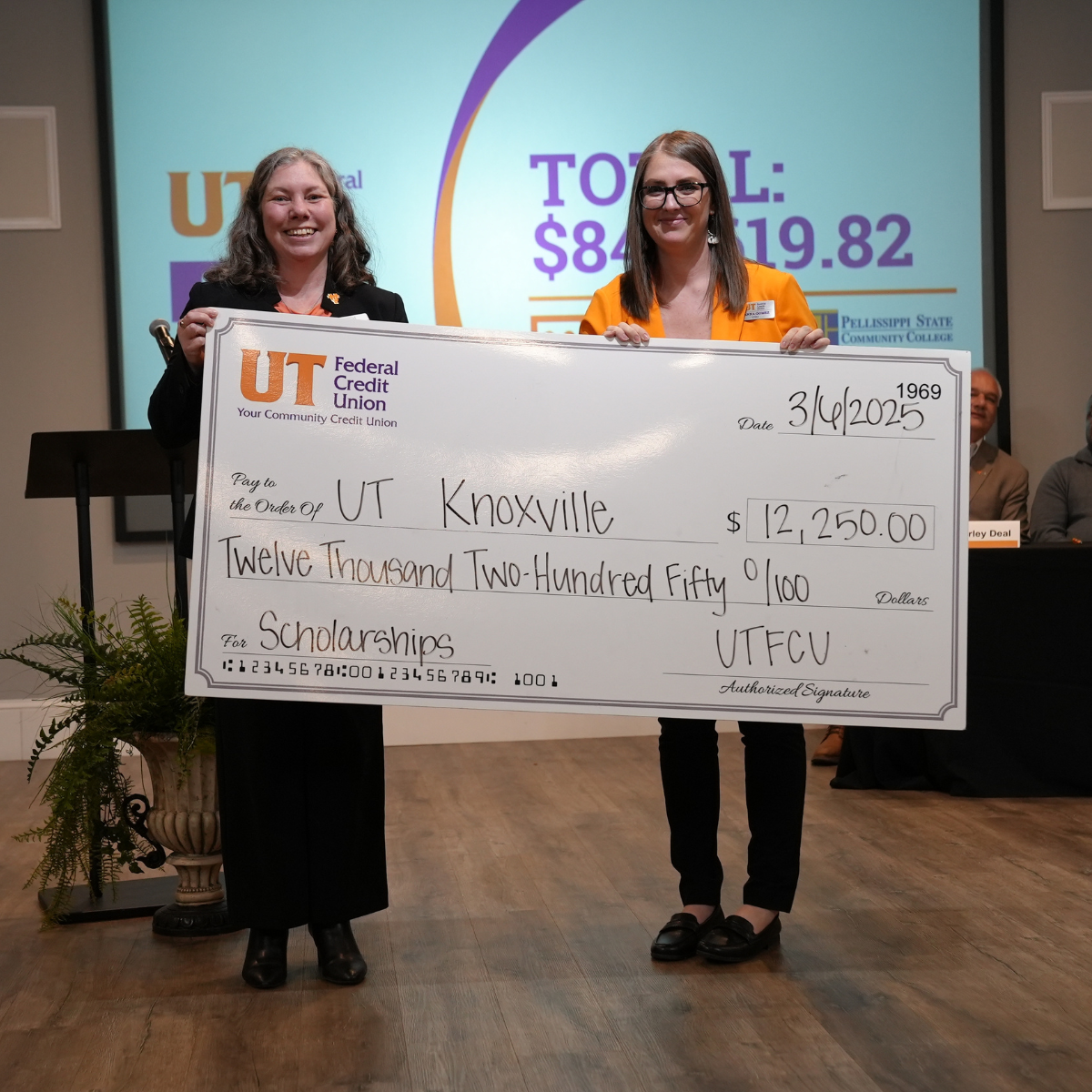

Reflecting on the 2024 UTFCU Annual Meeting

UT Federal Credit Union's 55th Annual Meeting was a night to remember! From celebrating our commitment to education to honoring Debbie Jones' incredible 29-year legacy and welcoming our new CEO, Kenyon Warren, see all the highlights from this special evening.

Beware of Spoofing Scams: Protect Your Personal Information

Scammers are using spoofing techniques to impersonate UTFCU and other trusted organizations. Learn how to recognize and protect yourself from these fraudulent calls.

Maximizing Your Tax Refund: Smart Strategies for Financial Growth

Make the most of your tax refund! Discover smart ways to save, invest, and grow your financial future with these strategic tips.

Smart Money Moves: A College Student's Guide to Financial Success

Managing money in college can be challenging, but with the right tools and knowledge, you can set yourself up for financial success. Learn how to budget, build credit, manage student loans, and protect yourself online. Plus, discover how UTFCU can support your financial journey with expert guidance and resources!

Is It Too Late to Start Saving for Retirement?

It's never too late to start planning for retirement! Discover practical strategies, the power of compound interest, and how UT Federal Credit Union can help you secure your future. Start your journey today!

5 Signs It Might Be Time to Refinance Your Loan

Is it time to refinance your loan? Discover 5 signs that refinancing could help you save money, lower your payments, or better align with your financial goals. Learn how UT Federal Credit Union can guide you through the process!

Start 2025 Strong with These Financial Resolutions

Achieve your financial goals in 2025 with these simple, actionable tips.

Unlocking the Benefits of Share Certificates at UTFCU

Discover how UTFCU's share certificates can help you grow your savings with guaranteed returns, competitive rates, and flexible term options tailored to you financial goals.

Stay Safe This Holiday Season: How to Avoid Common Shopping Scams

The holidays are here, but so are the scammers! Learn how to spot and avoid the most common holiday shopping scams with these essential tips to protect your finances and personal information.

Black Friday Shopping Tips: Outsmart Retail Tricks to Save Big

Discover the mind games retailers play on Black Friday to make you spend more—and learn simple strategies to outsmart them!

Welcome to UT Federal Credit Union! We are thrilled to have you here and look forward to serving you. As a member-owned financial institution, UTFCU is dedicated to providing exceptional service to our members. Here’s a bit more about us and what makes us unique.

Our Mission and Vision

At UTFCU, our mission is to provide comprehensive financial solutions to our members while fostering a sense of community and mutual support. Our vision is to be the preferred financial institution for individuals and businesses in our service areas, promoting financial well-being and economic growth.

Our History

Established with a strong foundation in serving the community, UTFCU has grown to support members across Anderson, Blount, Knox, Loudon, Martin, Memphis, and Union Counties in Tennessee. Over the years, we have expanded our services and reach, continuously evolving to meet the changing needs of our members.

Membership Benefits

One of the key advantages of joining UTFCU is that we are a not-for-profit organization. This means that our profits are returned to our members in the form of lower rates, higher interest on deposits, and reduced fees. Here are some highlights of what you can expect as a member:

- Personalized Service: Our members are our top priority, and we are committed to providing personalized financial solutions that cater to your unique needs.

- Community Focus: We actively participate in and support local community initiatives, ensuring that our contributions have a positive impact.

- Member Ownership: As a member, you are an owner of the credit union. This gives you a voice in how we operate, with the ability to vote in board elections and contribute to decision-making processes.

How to Join

Becoming a member of UTFCU is easy and can be done in a few simple steps:

- Online Application: Visit our online application portal to complete the process from the comfort of your home.

- Visit a Branch: Stop by any of our branches with your government-issued ID, proof of address, Social Security card (if possible), and opening deposit. Our friendly staff will assist you in setting up your account.

- Give Us a Call: Contact us at (865) 971-1971 or (800) 264-1971, and we will guide you through the membership process over the phone.

Services We Offer

UTFCU provides a wide range of financial services designed to meet the diverse needs of our members. These include:

- Personal Banking: Checking accounts, savings accounts, money market accounts, IRAs, and more.

- Personal Loans: Auto loans, personal loans, student loans, mortgages, and home equity lines of credit.

- Business Banking: Business checking accounts, savings accounts, money market, lines of credit, commercial real estate loans, commercial vehicle loans, and SBA loans.

- Digital Banking: Online and mobile banking services to manage your accounts anytime, anywhere.

- Financial Education: Tools and resources to help you make informed financial decisions and achieve your financial goals.

Community Involvement

We take pride in our community involvement and strive to give back through various initiatives and programs. We focus on creating a positive impact and supporting the well-being of our communities.

Contact Us

For more information or if you have any questions, please feel free to contact us via email or call us at (865) 971-1971 or (800) 264-1971. You can also visit any of our branches or explore our website to learn more about our services and how we can assist you.

Join UT Federal Credit Union today and experience the benefits of being part of a member-owned, community-focused financial institution. We look forward to welcoming you!

« Return to "Blog"