Smart Money Moves: A College Student's Guide to Financial Success

College is an exciting time filled with new experiences, but it also comes with financial responsibilities that can be overwhelming. Managing money wisely can set you up for long-term success, so understanding budgeting, credit, banking basics, and cybersecurity is crucial. Let's break it all down!

Create a Budget That Works for You

Budgeting is a fundamental financial skill that will help you track your income and expenses, ensuring you can cover essentials while still having fun. Here are three popular budgeting methods:

- 50/30 Budgeting Method

- 50% of your income goes toward necessities (rent, food, transportation).

- 30% is for wants (entertainment, dining out, shopping).

- 20% is for savings and paying off debt.

- Zero-Based Budgeting Method:

- Every dollar you earn is assigned a job, whether for bills, savings, or spending.

- At the end of the month, your income minus expenses should equal zero.

- Envelope Budgeting Method:

- Allocate cash into envelopes for different spending categories.

- Once an envelope is empty, you stop spending in that category.

Pick the budgeting method that works best for your lifestyle and financial habits!

Start Building Credit as a College Student

Your credit score impacts your ability to rent an apartment, get a car loan, and even land certain jobs. Here's how to start building good credit in college:

- Open a credit card and use it responsibly.

- Always pay your bills on time.

- Keep your credit utilization low (use less than 30% of your available credit).

- Avoid opening too many accounts at once.

By practicing good credit habits early, you'll set yourself up for financial stability after graduation.

Money Management for College Students

Managing your money wisely means being mindful of your spending and saving habits. Consider these tips:

- Track your expenses using a budgeting app or spreadsheet.

- Set financial goals, whether saving for spring break or an emergency fund.

- Take advantage of student discounts on everything from software to streaming services.

- Cook at home instead of eating out—it saves money and is often healthier.

- Automate your finances by setting up automatic bill payments and savings transfers.

Common Financial Mistakes to Avoid

Many college students make money mistakes that can have long-term consequences. Here are a few to watch out for:

- Overspending on credit cards and carrying a balance with high interest.

- Ignoring loan interest—some student loans accrue interest while you're still in school.

- Not having an emergency fund, which can lead to relying on credit cards in tough situations.

- Falling for scams, such as fake job offers or phishing emails.

Avoiding these pitfalls will keep you on the right track financially.

Debt Management

Debt can pile up quickly in college, so it's important to manage it wisely:

- Avoid unnecessary debt by borrowing only what you need for school.

- Make at least the minimum payments on any loans or credit cards.

- Pay off high-interest debt first (like credit cards) to save money in the long run.

- Consider consolidating student loans if it makes repayment easier.

Student Loans: What You Need to Know

Many students rely on loans to finance their education. Here are some basics to understand:

- Federal vs. Private Loans: Federal student loans typically offer lower interest rates and more repayment options than private loans.

- Interest Accrual: Some loans start accumulating interest while you're in school, so paying even a little each month can help.

- Grace Periods: Most student loans give you a six-month grace period after graduation before payments start.

- Repayment Plans: Choose a repayment plan that fits your post-college budget—options include standard, graduate, and income-driven repayment plans.

Basic Banking Terminology

Understanding banking terms can help you avoid costly mistakes. Here are some common ones:

- Cashing a Check vs. Making a Deposit: Cashing a check gives you money immediately, and depositing it adds the amount to your bank account for later use.

- Overdraft Fees: Charges that occur when you spend more than your account balance.

- Interest Rate: The percentage a bank pays you for keeping money in your savings account.

- Minimum Balance Requirement: The minimum amount required in your account to avoid fees.

More information on Banking Terminology.

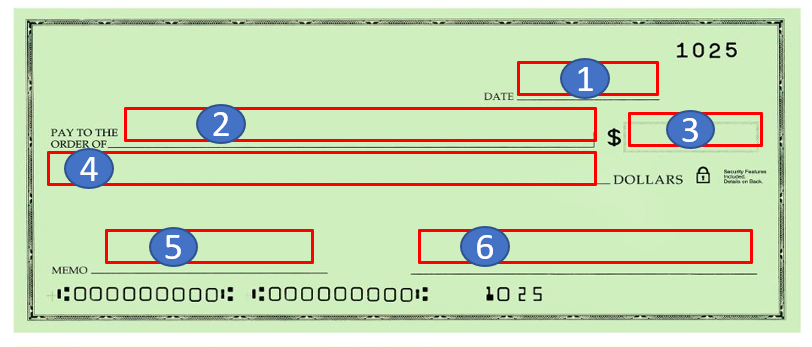

How to Properly Write a Check

Even in a digital age, knowing how to write a check is useful:

- Date: Write the current date at the top.

- Pay to the Order of: Write the recipient's name.

- Amount in Numbers: Fill in the amount numerically (e.g., 50.00).

- Amount in Words: Spell out the amount (e.g., Fifty and 00/100).

- Memo Line: Note the purpose of the check (e.g., "Rent" or "Textbooks").

- Signature: Sign your name to validate the check.

The Importance of Cybersecurity

As a college student, you're constantly connected online, making you a prime target for scams. Protect yourself with these cybersecurity tips:

- Use strong passwords and change them regularly.

- Enable multi-factor authentication on your banking and email accounts.

- Avoid public Wi-Fi for sensitive transactions.

- Recognize common scams, such as phishing emails asking for personal information.

- Monitor your accounts regularly for any suspicious activity.

Staying aware of cybersecurity threats can prevent identity theft and fraud. Visit our article on Scam Awareness for more information.

How UTFCU Can Help with Your Financial Journey

At UT Federal Credit Union, we're here to support your financial success. Whether you need guidance on choosing the right account, understanding how to build credit, or improving your financial literacy, we've got you covered:

- Helping You Choose the Right Account: We can walk you through your options and help you select the best account for your financial goals.

- Financial Literacy Resources: Our blog and educational materials cover essential financial topics, from budgeting to credit building.

- GreenPath Financial Wellness: Through our partnership with GreenPath, we offer free budgeting tools and financial counseling to help you stay on track.

- Personalized In-Branch Service: Our team is always available to answer your questions and provide one-on-one guidance on managing your finances. Find a branch.

We're committed to helping you gain financial independence and confidence.

Final Thoughts

Financial literacy is a skill that will benefit you for a lifetime. By budgeting effectively, managing credit, understanding student loans, and protecting yourself online, you'll be on the path to financial success. UT Federal Credit Union is here to help you every step of the way!

« Return to "Blog"