Turn Spare Change into Smart Savings

With UT Federal Credit Union's U Save Round-Up, your everyday debit card purchases are automatically rounded up to the nearest dollar, and the spare change is tucked away into your savings. It's a simple, hands-off way to grow your savings without even thinking about it— and it earns an impressive 5.00% APY* to help your money grow even faster. Every swipe brings you closer to your savings goals.

You spend. You save. Automatically.

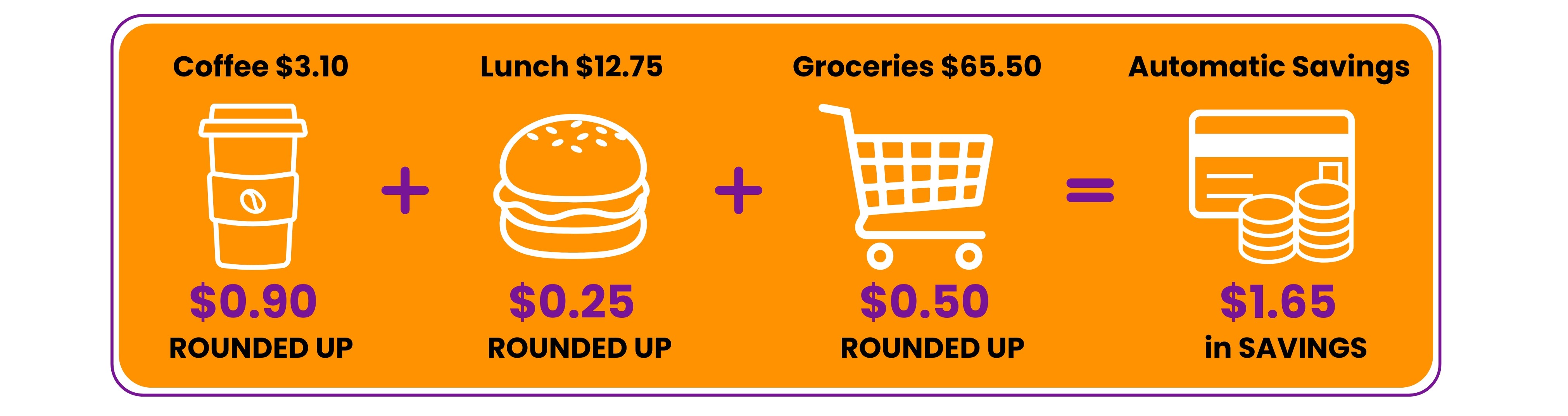

How It Works

Use your UTFCU debit card.

We round your purchase up to the nearest dollar.

The spare change is transferred into your U Save account (in one daily transfer).

How to Opt-In

For Current Members

Ready to Round Up and Save?

Log in to Digital Banking and opt in to U Save Round-Up today!

For Non-Members

Not a Member Yet? Let's Fix That.

Open a UTFCU checking account and enroll in U Save Round-Up!

Why You'll Love It

Save effortlessly—automatically!

Watch your balance grow over time.

Funds stay in your savings and are always accessible.

*APY = Annual Percentage Yield. Rate effective 5.21.2025. Rate is subject to change or end at any time. No other deposit methods are permitted into the U Save account. Funds can be withdrawn at any time. Terms and conditions apply. Federally insured by NCUA.

Rates

| Account | Dividend Rate | APY** |

|---|---|---|

| Regular Shares | 0.05% | 0.05% |

| Health Savings – $.01 and up | 0.10% | 0.10% |

| Holiday Club | 0.50% | 0.50% |

| Cumulative IRA | 0.10% | 0.10% |

| U Save Round-Up*** | 4.89% | 5.00% |

*Maintenance or activity fees could reduce earnings on the account. **APY = Annual Percentage Yield. Shares insured up to $250,000 by the NCUA, an agency of the Federal Government. IRAs are insured for up to $250,000. ***APY = Annual Percentage Yield. Rate effective 5.21.2025. Rate is subject to change or end at any time. No other deposit methods are permitted into the U Save account. Funds can be withdrawn at any time. Terms and conditions apply. Federally insured by NCUA. | ||

| Account | Dividend Rate | APY** |

|---|---|---|

| U Earn Savings*** - $25,000 - $99,999 | 2.77% | 2.80% |

| U Earn Savings*** - $100,000 - $249,999 | 3.25% | 3.30% |

| U Earn Savings*** - $250,000 and over | 3.64% | 3.70% |

*Maintenance or activity fees could reduce earnings on the account. **APY = Annual Percentage Yield. Shares insured up to $250,000 by the NCUA, an agency of the Federal Government. IRAs are insured for up to $250,000. ***APY = Annual Percentage Yield. Dividend rate displayed is subject to change without notice. This is a tiered account. Minimum deposit of $25,000. Higher dividends are earned when you maintain a UTFCU consumer checking account and receive at least $500 in total direct deposits per month. If qualifications are not met, account earns the regular share rate. Federally insured by NCUA. | ||